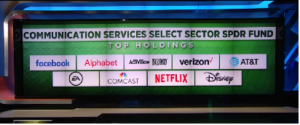

Extra! Extra! XLC is the new ETF that ties telecom and media constituents into one exchange-traded fund! For those with a view towards latest and greatest ETF products, eyes and ears are on the Communications Services Select SPDR Fund (NYSEARCA: XLC) — “it tracks the Communication Services Select Sector Index and “seeks to provide precise exposure to companies from the media, retailing, and software & services industries in the U.S.”

Wow. That’s a bucket full of precision when considering the constituents of XLC include among others, Facebook (NYSE:FB), Alphabet Inc (NASDAQ: GOOGL), Activision (NASDAQ: ATVI), Verizon (NYSE: VZ), Comcast (NASDAQ: CMCSA), Netflix (NASDAQ: NFLX) The good news is that ETF maestro Andrew McCormond, Managing Director ETF Solutions for WallachBeth Capital distills the appeal of XLC, the latest innovative exchange-traded fund and one that might be the FANG-style ETF for portfolio managers who have yet to find a one-stop product that meets their portfolio allocation needs.

Wow. That’s a bucket full of precision when considering the constituents of XLC include among others, Facebook (NYSE:FB), Alphabet Inc (NASDAQ: GOOGL), Activision (NASDAQ: ATVI), Verizon (NYSE: VZ), Comcast (NASDAQ: CMCSA), Netflix (NASDAQ: NFLX) The good news is that ETF maestro Andrew McCormond, Managing Director ETF Solutions for WallachBeth Capital distills the appeal of XLC, the latest innovative exchange-traded fund and one that might be the FANG-style ETF for portfolio managers who have yet to find a one-stop product that meets their portfolio allocation needs.

New ETF merges tech and media from CNBC.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com.

If you’re on a path to raise capital for a new hedge fund, a fintech initiative or a blockchain-startup, the first step is packaging your pitch and presenting the opportunity within a properly-prepared Prospectus. The go-to firm to assist you? Prospectus.com LLC. Straightforward, Smart and Bespoke Services.