Its all about Securities Lending aka Sec Lending for certain ETFs to outperform and be profitable for investors looking for ways to offset the fund’s expense fees. MarketsMuse salutes Eric Balchunas at Bloomberg for his a.m. report: “Hedge Funds Will Pay for You to Own Small-Cap ETFs”

(Bloomberg)- With many exchange-traded funds already dirt cheap, everyone is waiting for the first free ETF. Turns out, it’s already here.

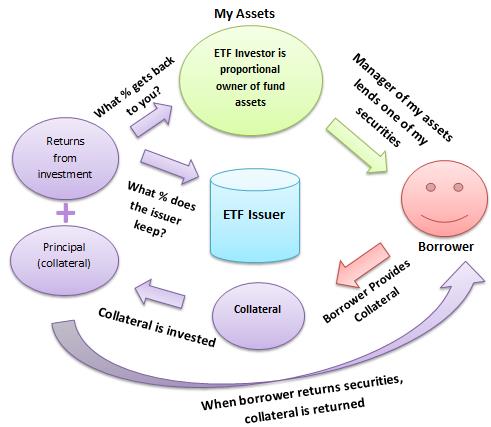

In certain pockets of the industry, ETFs are consistently beating the return on the indexes they’re meant to track. Theoretically, an ETF should lag its index by roughly the amount of its fee to investors. But that doesn’t account for revenue from securities lending. ETFs can lend out as much as 33 percent1 of their equity holdings to short sellers in return for a small fee. ETFs can then use that revenue to offset the expense ratio.

In some cases, an ETF has securities in its portfolio that are in such high demand from short sellers that the lending fees add up to more than the fund’s expense ratio—so the ETF not only makes up its fees but also pushes returns above those of the index.

The most prominent examples of this phenomenon are in ETFs that track small-cap indexes. State Street Corp., BlackRock Inc.’s iShares, and Vanguard Group Inc. all have small-cap ETFs—with more than $30 billion in collective assets—whose the extra revenue from securities lending leads to returns that top those of the indexes they track.

Read Eric’s story via this link