MarketMuse update is courtesy of MarketWatch. Virtus Investment Partners (NASDAQ: VRTS), multi-manager asset management business, announced that they have reached an agreement with ETF Issuer Solutions (ETFis) , a comprehensive platform for listing, operating, and distributing exchange traded funds. Virtus Investment Partners will acquire the majority interest from the deal. The transaction…Read More

MarketsMuse update courtesy of extract from 19 December edition of FT.com, with reporting by Tracy Alloway Extreme movements in the prices of bonds, commodities and other assets have prompted regulators at the Federal Reserve Bank of New York to take a closer look at the inner workings of exchange traded…Read More

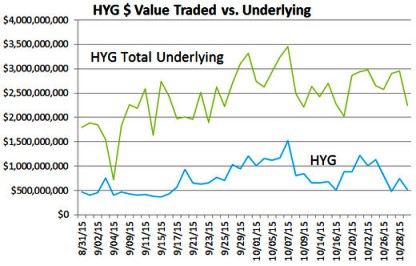

Courtesy of Zach Hascoe/WisdomTree Investments We have heard it over and over: Exchange-traded funds (ETFs) are wrappers, and the true liquidity of an ETF is derived from its underlying constituents.1 While that statement is true, it does not completely explain different types of liquidity that can exist in an ETF.…Read More

Courtesy of Tom Steiner-Threlkeld Nasdaq OMX Group said it expects the re-launch of its PSX exchange as an exchange-traded fund marketplace to take place in May. Final approval of the refashioning the “price size exchange” as a “price time” exchange focused on exchange-traded products must come from the Securities and Exchange Commission.…Read More

Courtesy of Bloomberg LP reporter Nina Mehta 2013-03-22 22:29:10.364 GMT U.S. regulators approved Nasdaq Stock Market’s request to allow the sponsors of some exchange- traded funds to offer payments to market makers. The Securities and Exchange Commission decision loosens a ban on the compensation that has been in place since…Read More

Courtesy of James Armstrong If issuers of exchange-traded funds could pay to attract market makers to their products, would there be more liquidity in ETFs? Or would paying market-makers create a dangerous precedent and harm long-term investors? Or, is Tim Quast, MD of trading analytics firm "Modern Networks IR" correct…Read More

Courtesy of Rosalyn Retkwa The Securities and Exchange Commission has decided not to decide yet whether to approve proposals by Nasdaq and the New York Stock Exchange to pay market makers to make better markets in thinly traded ETFs. The proposals would require an exemption from a current prohibition against…Read More

Sam Bankman-Fried (aka "SBF") Fries Clients and Customers FTX Crypto Exchange Bankruptcy Explained; Investors Loss Estimated at $2bil; Exchange Customers Loss Estimated at $4bil-$5bil (so far..) Comparisons Made to Lehman Brothers Scandal; Sam Bankman-Fried Scheme More Similar to Jon Corzine Shenanigans when he ran MF Global into the ground. FTX…Read More

[caption id="attachment_5639" align="alignleft" width="150"] NYSE DMM Citadel Securities started as a HFT prop trading firm[/caption] Something funny happened on the way to the floor of the New York Stock Exchange last week; Citadel Securities and Virtu Financial, two of the three biggest NYSE “Designated Market-Makers” aka “DMM”) --also domain experts…Read More

Stock Price Implosion Leads Some to Challenge Current Market Structure; HFT Firms Are Under Attack, Again… Heads Up to High-Frequency Firms: Time to Hire a PR Crisis Manager Again, Call Your Lobbyists, Book Your Plane Tickets to Washington DC. Before “bidding on” to the anti-HFT and anti-ETF remarks circulated by…Read More

Trifecta Month for GTS; NYSE DMM, Quant-Trading Powerhouse and Fin-Tech Think-Tank Now Aligned With Investment Bank Specializing in Primary Debt & Equity Capital Markets GTS, the NYSE's Top DMM, and one of the global trading market's leading multi-asset electronic market-makers, is on a strategic deal-making binge. On the heels of…Read More

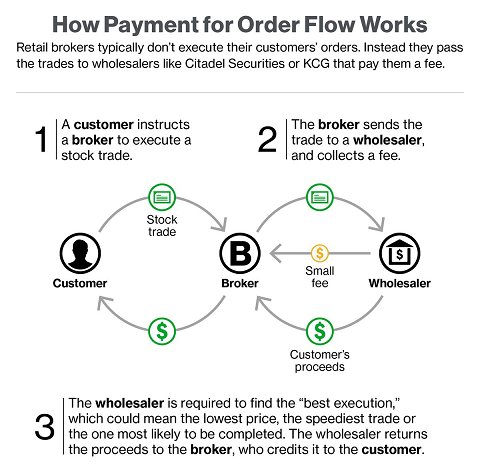

In a July 18 NYT op-ed piece "Wall Street Profits by Putting Investors in the Slow Lane" submitted by Jonathan Macey, a professor at Yale Law School and David Swensen, the chief investment officer of Yale University, the spirit debate topic of payment-for-order-flow schemes, aka rebates paid by the various stock exchanges to…Read More

According to MarketsMuse market structure mavens, if you can say "dis-intermediate" five times in under 5 seconds, or if you can simply spell the word (without looking at this blog post), then "you'll get the joke" i.e. exchange operator Bats Global Markets (acquired last year by CBOE for $3.2bil) is…Read More

Cheryl Cargie, head trader at buy-side fund manager Ariel Investments in Chicago, said that while the buy side is looking for more from its sales trader coverage, it depends on whether a buy side trader is representing a passive or active strategy. For a veteran with over 20 years in…Read More

The high-frequency arms race, aka "Battle Between Wall Street-style Transformers" has extended to trading in USTs and HFT firms are invading the US Treasury market, according to latest from BusinessInsider.. (BusinessInsider)-High-frequency traders have taken over the market for US Treasuries, and a bunch of market participants say they're alarmed by the…Read More

Within the context of market structure, the ever-evolving rules of the road for those attempting to navigate how and where to secure best pricing when executing equities orders has become so convoluted thanks to pay-to-play rebate schemes, its not only the curators at MarketsMuse who are scratching their heads, even…Read More

The US SEC apparently has its cross-hairs on so-called 'geared ETFs,' those high-testosterone, levered instruments that incorporate derivatives so as to deliver an advertised 2x or 3x return for certain strategies versus a typical 1:1 correlation provided by plain vanilla exchange-traded funds. The SEC proposal would effectively ban the use…Read More

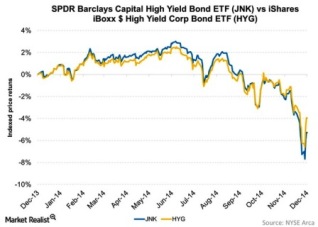

There continues to be a call for clarity with regard to the topic of corporate bond ETF liquidity and where/how corporate bond ETFs add or detract within the context of investors ability to get 'best execution' when secondary market trade in underlying corporate bonds is increasingly 'illiquid.' This not only…Read More