MarketsMuse followers have been reminded more than a few times that conventional wisdom requires investors to keep their eyes on corporate bond spreads so as to have a clear lens when considering the outlook for equity prices on a medium-to-longer time frame. The relationship between high-yield debt,most-often measured by HYG…Read More

Most sophisticated investors, whether Tier 1 institutional investment managers, 'top minds' across the sell-side, or the truly savvy, self-directed types should all agree that fixed income market signals, and investment grade credit spreads in particular are a prelude to what equities market can expect to happen. Whether the 'lag time'…Read More

MarketsMuse fixed income fix is courtesy of extract from Mischler Financial Group Mar 17 desk notes aka "Quigley's Corner" and authored by Ron Quigley, Managing Director and Head of Fixed Income Syndicate for this boutique brokerdealer owned and operated by Service-Disabled Veterans and recipient of Wall Street Letter's 2015 Award…Read More

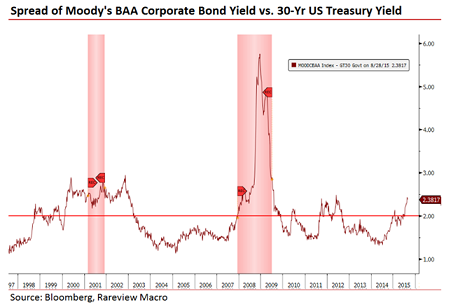

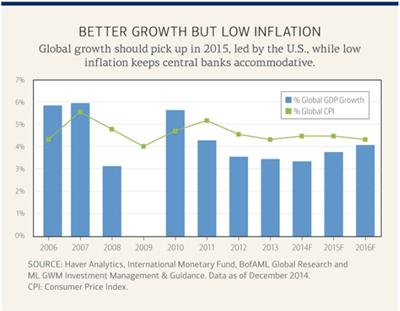

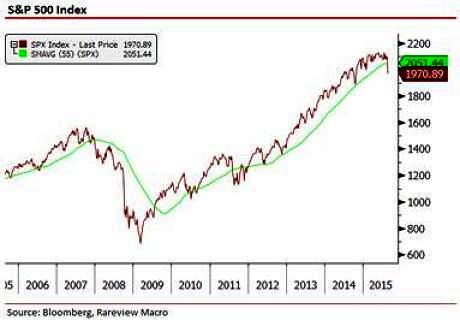

"To put it bluntly, what headline writers or traders are selling you today is a load of bollocks." Neil Azous, Rareview Macro LLC When global macro guru Neil Azous of Rareview Macro appeared on CNBC midday yesterday, MarketsMuse curators had already absorbed and relayed his recent views about energy prices,…Read More

Courtesy of WSJ Matt Wirz Corporate bond exchange-traded funds attracted investors in record numbers during the credit bull run of the past three years. They also attracted criticism for trading with more volatility than the bond markets they were designed to track. With the selloff in Treasury bonds rattling credit…Read More

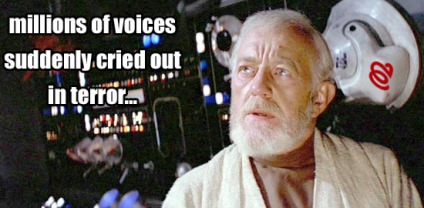

Professional Investment Community Cries Out in Agony and They Don’t Yet Know Exactly Why MarketsMuse Strike Price and Global Macro curators voted the Oct 5 edition of global macro advisory firm Rareview Macro's Sight Beyond Sight the best read of the week. Yes, its only Monday, but those who follow…Read More

MarketsMuse Global Macro and Fixed Income desks converge to share extract from 23 July edition of Rareview Macro commentary via its newsletter "Sight Beyond Sight". For those not following the corporate bond market, most experts will tell you the equities markets follow the bond market--which in turn is a historical…Read More

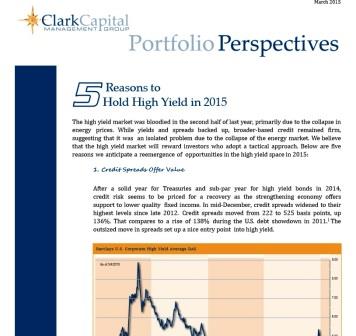

While high-yield bond followers are seemingly caught between a rock and a hard place as interest rates may be poised to pick up, some expert investors are positing that high yield positioning is precisely the tactical approach to maintain.. The following MarketsMuse.com fixed income fix is courtesy of contributed article…Read More

MarketsMuse update courtesy of debt capital markets desk notes distributed to clients of boutique brokerdealer Mischler Financial under the banner "Quigley's Corner". Mischler Financial, the financial industry's oldest and largest minority firm owned/operated by Service-Disabled Veterans received the 2015 Wall Street Letter Award for Best Research/BrokerDealer. [caption id="attachment_2881" align="alignleft" width="150"]…Read More

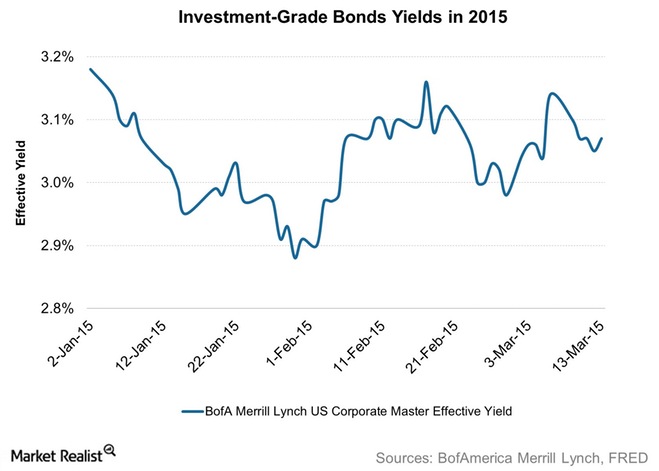

[caption id="attachment_2790" align="alignleft" width="150"] Ron Quigley, Mischler Financial Group[/caption] MarketsMuse fixed income fix for Feb 5 is courtesy of Industry Veteran and debt capital markets guru Ron Quigley, Managing Director and Head of Fixed Income Syndicate for Mischler Financial Group, the sell-side's first and foremost investment bank/institutional brokerage boutique that…Read More

As Junk Bond ETF outflows accelerated in the past 6 weeks, MarketsMuse editor team has been intrigued by two most recent articles profiling where and whether it makes sense (and hence dollars) for high-yield bonds (and respective ETFs) within a portfolio. Per articles today from RIA Larry Swedroe via ETF.com…Read More

Courtesy of John Spence Junk bond ETFs have enjoyed four solid years of returns while investors’ hunger for income-producing assets has pushed the sector’s yields down near record-low levels. As 2013 gets underway, some investors are again wondering if high-yield corporate debt is overvalued after such a strong run. The…Read More

By Mary Childs - Sep 17, 2012 Exchange-traded funds are poised to overtake credit derivatives by year-end as a way to speculate on junk bonds. The value of corporate securities held by the five-largest junk ETFs almost doubled in the past year to a record $31.4 billion, while the net…Read More

MarketsMuse Fixed Income Update "Corporate Bond Market- Balancing on a Knife Edge" is courtesy of extract from the 10.02.15 weekend edition of "Quigley's Corner", a daily synopsis of the investment grade corporate bond market and rates trading space authored by Ron Quigley, Managing Director of investment bank and institutional brokerage…Read More

If the second shoe is actually falling as US (and all other) equities markets appear to indicate this morning, MarketsMuse ETF and Global Macro editors were stimulated by having Sight Beyond Sight with this morning's coffee, courtesy of Rareview Macro's Neil Azous. Of particular interest, Azous points to Mebane Faber’s…Read More

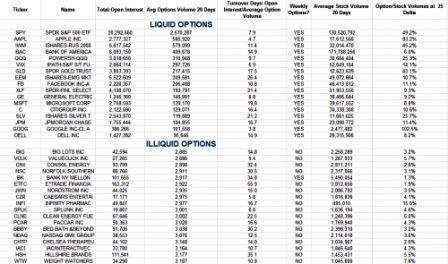

MarketsMuse.com Strike Price update strikes at the heart of how the financial industry’s new regulatory regime is impacting liquidity across the institutional options market, courtesy of 09 April coverage by MarketsMedia.com. Regulatory requirements that dealers keep more capital on their balance sheets is squeezing options liquidity for institutional traders, who…Read More

MarketsMuse.com blog update courtesy of press release from Tabb Group and profiles new research report focused on institutional investors’ growing use of corporate bond ETFs. NEW YORK & LONDON--(BUSINESS WIRE)--In new research examining accelerating growth in the corporate bond exchange-traded fund (ETF) market, which has seen assets under management (AuM)…Read More

Below commentary is courtesy of extract from a.m. edition of today's Rareview Macro's "Sight Beyond Sight" A Simple View: US Dollar, Gold, SPX, UST's [caption id="attachment_1904" align="alignleft" width="143"] Neil Azous, Rareview Macro LLC[/caption] The objectives we have laid out continue to materialize across the themes we are focused on. The…Read More