Professional Investment Community Cries Out in Agony and They Don’t Yet Know Exactly Why

MarketsMuse Strike Price and Global Macro curators voted the Oct 5 edition of global macro advisory firm Rareview Macro’s Sight Beyond Sight the best read of the week. Yes, its only Monday, but those who follow this newsletter as we do (along with a discrete universe of savvy investment managers and hedge fund traders) have discovered that a certain degree of prescience can be contagious when trade ideas are presented with a pragmatic, transparent and easy to understand thesis.. Below are the lead-in topics and followed by selected excerpts…

- A Great Disturbance in the Force – Oil, Materials, & Momentum Strategies

- Portfolio Overlay – Two Inexpensive Ways to Add Downside Convexity

- New Trade – Short 2-Year US Treasuries via Put Options

For those of you who still have to make up your mind on whether we can help you or not with your daily investment process, today’s edition of Sight Beyond Sight is a good example of what makes us different. The majority of the morning notes you have received today all center on the “bad news is now good news” meme or how lower interest rates for longer will be supportive for risk assets. Of course, none of them have highlighted that financial conditions have been tightening all year long so despite the call for lower interest rates for longer the real world is not buying that unless credit spreads tighten. Instead, we will give you a rareview into how risk takers are faring across various strategies. Additionally, we provide three new trade ideas.

In the 1977 iconic movie Star Wars: Episode IV-A New Hope, following the scene where the Death Star destroys the planet Alderaan, the Jedi Knight, Obi-Wan Kenobi, said: “I felt a great disturbance in the Force, as if millions of voices suddenly cried out in terror and were suddenly silenced. I fear something terrible has happened.”

I have started with that quote because it seems the best way to describe the Start of the new week for the professional investment community. Take a look at the below observations and it will be easier to understand why risk takers are “crying out in terror” and for many of them “something terrible has happened”.

If you are a global macro fund, then liquidity is not going to be your friend today as you defend core strategies that are deeply entrenched. For those who have been living on a deserted island the remaining long US dollar positioning is mostly versus emerging market FX and G10 commodity currencies, rather than other reserve currencies such as the euro, Japanese yen, Pound sterling, and the Swiss franc.

If you are a long/short strategy, you already know what is happening because it started well over a week ago.

You just did not want to believe it. Not to worry, a further unwinding in the long Financial/healthcare versus short Material/Energy sector strategy will help you finally come to grips with reality. If you are a quantitative fund, up until really last Friday in both Europe and the US, you have had the benefit of being part of the number one factor input and best performing strategy this year –that is, MOMENTUM. Sadly for you, the reversal of that strategy is a lot more violent on the way out then chasing it on the way in. Perhaps you will take back your 15 minutes of old fame from the new guys-Risk Parity and Target Volatility funds?

The conclusion would be that the worst-of-the-worst–energy, materials and bottom 15% of single stock performers–is now in play from the long side for whatever reason –its “go time”, crude oil has bottomed, or gross exposure reduction is not near being completed.

Ok, here we go…

Rareview Macro Portfolio Overlay –Two Inexpensive Ways to Add Downside Convexity

The current price in S&P 500 futures is ~1950. The low on August 24th was 1831. The difference between the two is ~6%.Protecting against a 6% downside move, or 120 S&P 500 points, is an expensive exercise right now, and not one we are interested in. Instead, we are more worried about the second 6%, or the move down to 1720-1700 from 1831, especially the air pocket that is likely to develop once/if the August 24th intra-day low of 1831 is breached.

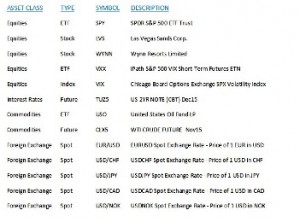

The problem is that we do not know the short-term direction of the S&P 500 index, including if it will first go to 2000 in the next 30-days but we are highly sensitive to an even larger move on the downside in the fourth quarter than what occurred in the third quarter. So working on these premises, what are the best strategies to deploy right now? We think having a two-tiered approach between the S&P 500 index and equity volatility, as measured by the CBOE VIX Index, is an optimal strategy.

We’ll look to dynamically manage both of these strategies side-by-side in the event that we see another leg lower in US equities. The two strategies we like are and the ones we deployed in the model portfolio late last week and posted via Twitter are….

To access the entire, un-excerpted edition of the Oct 5 Sight Beyond Sight, the following link will redirect you to Rareview Macro’s newsletter archive section. For those who do not already subscribe to the SBS newsletter, a FREE trial subscription (no credit card required!) is available. Please CLICK HERE TO CONTINUE

Neil Azous is the Founder and Managing Member of Rareview Macro, an advisory firm to some of the world’s most influential investors and the publisher of the daily newsletter Sight Beyond Sight®. Neil has close on two decades of experience across the financial markets, and is recognized as a thought leader in global macro investing. Prior to founding Rareview Macro, Neil was a Managing Director at Navigate Advisors where he specialized in constructing portfolios and advising on risk. His daily commentary was highly regarded by the institutional investing community and his success in delivering a forward-looking viewpoint on global markets helped lay the foundation for Sight Beyond Sight® to be built. On Wall Street, his career included roles at UBS Investment Bank and Donaldson Lufkin & Jenrette, where his responsibilities comprised of trading derivatives, hedging solutions, asset allocation and fundamental securities analysis. He began his career at Goldman Sachs in Fixed Income, after completing both the firm’s Analyst and Associate training programs, widely acknowledged as the pre-eminent and most coveted learning ground for undergraduate and graduate students. Neil completed graduate level coursework for a MS in Real Estate at New York University and received his BA in Business Administration from the University of Washington, where he is a member of the University of Washington Bothell Board of Advisors and was the recipient of the Bothell Business School 2013 Distinguished Undergraduate Alumnus Award. He is active in various charity and community organizations.