The battle between business news pontificaters across the 4th estate is in full season, as evidenced by a smart article yesterday by Bloomberg LP's Eric Balchunas and suggests that MarketsMuse curators are apparently not the only topic experts who noticed and took aim at a recent WSJ article that proclaimed…Read More

For followers of the global equity crowdfund movement and fintech aficionados who are fluent in 'what's next?', this is a big news week from the crowdfund world. Yesterday, MarketsMuse curators spotlighted a just-launched trading exchange that brings billions of dollars worth of private shares into the wacky world of secondary…Read More

While equities markets have zig-zagged since late summer with lots of volatility, leading to pretty much no change in major indices since late August, news media outlets have put their cross hairs on the ETF industry, which has been battered with criticism consequent to out-0f-context pricing that has riddled opening…Read More

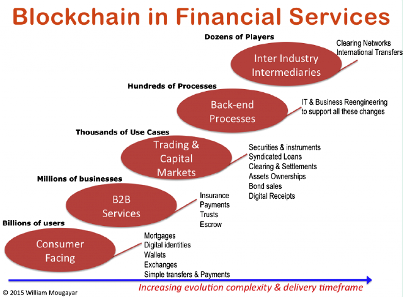

It doesn't take a "markets muse" who speaks in tech talk to know that Fintech is not only fashionable, its now mainstream. And, whilst the early "jibber jabber" surrounding Bitcoin was fodder for Wall Street naysayers, including JPM's Jamie Dimon, "the worm has turned" according to NYT columnist Nathaniel Popper,…Read More

MarketsMuse blog update is courtesy of BrokerDealer.com and initial reporting by InvestmentNews.com and profiles the deal between RIA titan Envestnet and mutual fund king Eaton Vance, which is now approved to promote its novel, actively-managed ETF product “NextShares.” NextShares are exchange-traded funds that are both actively managed and unlike any…Read More

As reported previously by MarketsMuse, actively-managed ETFs, aka AMETFs (or as Eaton Vance has dubbed their product: "NextShares ETMFs") are the next holy grail for Issuers of exchange-traded funds simply because these new-fangled products offer a refreshing new batch of flavors to a product category that has nearly 2000 issues…Read More

This post was written by Pete Hoegler, Washington DC-based Social Media Savant for The JLC Group. Three years after the JOBS Act was passed, it seems that Washington is back for more--a curtain call if you will--making it easier for small ventures to raise capital. The House Financial Services Committee in…Read More

MarketsMuse ETF “What’s Next?” update profiling 2 new market volatility trackers from AccuShares with a revised approach to VIX that seeks to mitigate the contango concerns and compares these pending products to the frequently discussed, but often misunderstood tracker CBOE Volatility Index. This post is courtesy of coverage from CNBC’s…Read More

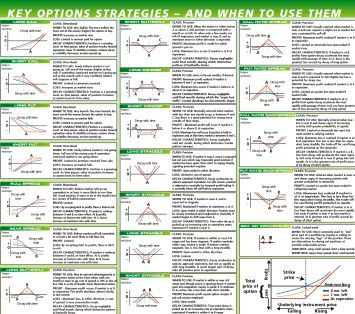

MarketsMuse Strike Price update profiles a “return from the past and into the future” look at what many veteran (and former) option mart floor traders had all but given up for lost thanks to the electronification and bifurcation of institutional options trading. We’re talking about those legacy, open-outcry trading pits,…Read More

MarketsMuse.com Strike Price section profiles trading systems vendor Dash Financial algorithm-based approach to securing options market “best execution” in the ever-increasing world of options mart fragmentation and the wacky rebate schemes that have proliferated across the electronic options exchange landscape. Below is courtesy of extracted elements from MarketsMedia.com April 20…Read More

Nuveen, known as one of the exchange-traded-fund industry’s first pioneers is back, and now they’re loaded for bear with a fresh angle courtesy of parent company TIAA-CREF. Courtesy of InvestmentNew.com, here’s the long and the short of the Nuveen’s reincarnation: Nuveen Investments Inc. is rebooting a campaign that may culminate…Read More

MarketMuse update is courtesy of CNBC. CEO and Founder of Betterment , Jon Stein, offered his commentary on this issue to CNBC. Betterment is an automated investing service that provides optimized investment returns for individual, IRA, Roth IRA & rollover 401(k) accounts. There's a natural progression in the way the public responds…Read More

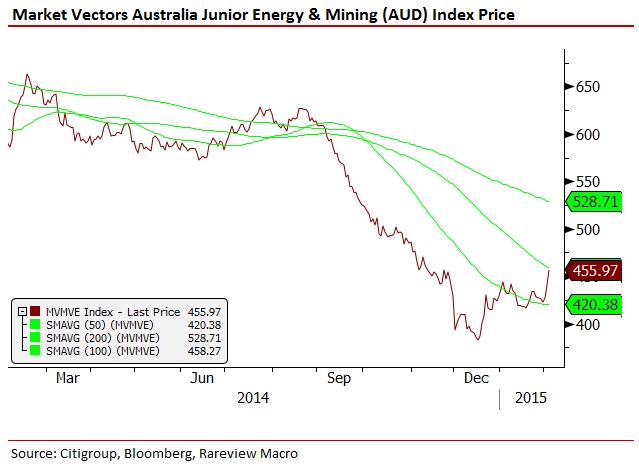

MarketsMuse update profiling a very intriguing options strategy for professional traders is courtesy of a.m. edition of "Sight Beyond Sight" , the global macro strategy-centric publication from Rareview Macro LLC. The MM editors include former option market-makers and we're reasonably confident that the following idea has not yet been considered…Read More

MarketsMuse global macro trading insight courtesy of extract from 4 Feb edition of Rareview Macro LLC’s “Sight Beyond Sight” with reference to $MVE and $MVMVE [caption id="attachment_2349" align="alignleft" width="150"] Neil Azous, Rareview Macro[/caption] There are a lot of moving parts overnight, including the continuing debate on whether crude oil has…Read More

As the exchange-traded fund marketplace continues to evolve, the recent introduction of "exchange-traded managed funds", aka ETMFs, has opened Pandora’s Box for those who have embraced "traditional" ETFs because of their transparency, real-time pricing (vs “end of day price setting”) and the relative ease of diagnosing liquidity by interrogating bid-offer…Read More

In what has become an ongoing “trilogy-type” story straight out of Hollywood, the WSJ reports today that Fidelity Investments is set to launch yet the latest “dark pool” initiative via a consortium of and exclusively for buy-side investment managers. The announcement comes on the heels of a recently-profiled NYSE initiative…Read More

“And the nominees are…” MarketsMuse update profiles ETF industry portal ETF.com annual awards for ‘Best Of’ across 25 different categories, with more than 100 nominees. Winnners will be announced at an awards dinner that will take place March 19 at Pier 61 in New York City. Below please find the…Read More

MarketMuse update courtesy of ETF.com’s Cinthia Murphy Steven Wallman was a commissioner with the SEC in the mid-1990s. An authority on securities markets and trading, today he leads an ETF-centered online brokerage, Folio Investing. Wallman is also keen on seeing the SEC start using a thoughtful “holistic” method to evaluate…Read More