Trump’s treasury team says Cuba's Vicana Sugar Company assets, including 60,000 acres of land and 48 miles of railroad belong to US investors. Ole to Compania Azucarera Vicana! Courtesy of a Trump White House that has more leaks than a rusty old pipe, sources “not authorized to speak on the…Read More

And The Winner Is….Institutional Investor Presents 2017 Top 40 Trading Tech Top Guns Who says trading technology wonks are under-appreciated within the context of recognition by industry followers? Certainly not MarketsMuse fintech curators, and definitely not Institutional Investor Magazine, which brings us their annual ranking of the top trading technologists…Read More

Business Plans Without Borders aka Borders.org is a novel non-profit intended to provide wind in the sail for startups launched by immigrants, refugees and under-served inner-city entrepreneurs. Created by long-time finance industry veteran Paul Azous, the altruistic initiative defies current political in-sensibilities and embraces the simple notion that small businesses…Read More

The 2016 BEST ETF funds and People in the ETF industry...Each year, ETF.com and Inside ETFs orchestrate a list of Best Of-the top ETF funds and ETF industry players who have made the greatest positive impact on the industry and investors in exchange-traded funds. The nomination process and voting process…Read More

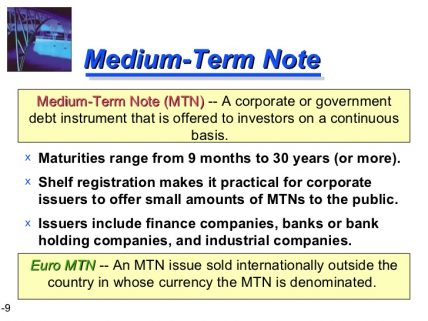

Fintech Fixed Income Trading & Fragmentation-What's Next? A Venue for Private Placement Bonds & MTNs Despite the seeming oversupply of electronic bond trading initiatives, the convergence of fintech and fixed income trading continues to spawn new electronic trading start-ups, bringing the total industry count to 128 venues. The latest player,…Read More

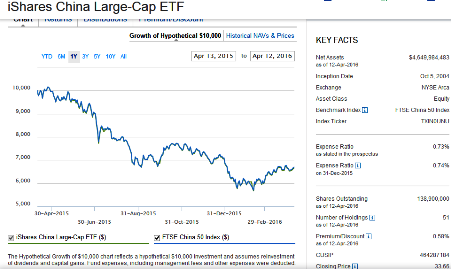

Latest Chinese Fintech FOF Completes Raise of 10-billion-yuan (US $1.8b) as Asia fintech funding continues to eclipse North America and EU allocation to financial technology initiatives.. (Econotimes.com) 28 December 2016- In a move to advance China as a financial and technology hub, Asia FinTech FOF, a foundation that aims to…Read More

Identifying the top fintech financiers is no easy task these days. It seems like only yesterday when MarketsMuse curators were among the first to advance the phrase "fintech" in the course of profiling startups seeking to disrupt the financial services sect, many of which have been led by sell-side veterans who…Read More

Nobody can accuse veteran government bond market broker and fintech poster boy David Rutter of being single-minded. The former Prebon Yamane exec, who later migrated to inter-dealer broker ICAP where he became of head of electronic trading, then did a stint as CEO of fixed income and FX platform BrokerTec,…Read More

Following a decade of new exchange launches, which led to a series of aggressive fee competition to attract order flow and elevated the 'pay-for-order-flow' game, the more current trend towards consolidation, fueled by an industry-wide race to zero fees and commissions is sparking rumors that the CBOE and BATS are…Read More

(RaiseMoney.com)-Minneapolis-based Stratifund, which models itself as a modern day version of a traditional Wall Street "independent equity research firm" has become the first such firm to plant its flag on the crowdfunding beachhead and bring objective analysis to crowdfund deals. Led by a cadre of Wall Street-trained wonks and crowdfund…Read More

Start-up corporate bond trading system OpenBondX is hoping to pull a rabbit out of its hat and jump start activity by emulating what the universe of equities-centric electronic exchanges and ATS platforms do in order to attract order flow to their respective venues: pay broker-dealers for orders given to them…Read More

Call it a Rat's Nest, a Rabbit Hole, or a Rubik's Cube, but no certified marketsmuse can dispute the fact the ETF industry has become a Spider's Web of complexity when it comes to the assortment of products being promoted. And, who more qualified to advocate on behalf of a…Read More

For those following global macro think tank Rareview Macro's "Sight Beyond Sight", you already know that the firm's chief strategist Neil Azous is on a roll and the firm's model portfolio is outpacing many who have an ax in global macro style investing. Today's edition of the firm's commentary caught…Read More

Blythe Masters, the former grand dame of derivatives for investment bank JP Morgan, who after a less-than-glorious exit from her senior role overseeing credit derivatives for House of Morgan and who reinvented herself as a blockchain babe and leads digital ledger startup Digital Asset Holdings, has proven that every cute…Read More

Eaton Vance Corp. today launched the first-ever non-transparent, actively-managed ETFs. Their new creation is called an exchange-traded managed fund (ETMF) and goes under the brand name NextShares. Quite a coup considering last week's MarketsMuse story "SEC Chair White Says I've Got a Dream" [for the SEC to actually read offering…Read More

MarketsMuse ETF and Fixed Income curators have frequently spotlighted the ongoing debates as to whether corporate bond ETFs, and in particular, junk bond-specific exchange-traded-funds pose special risks. Some argue that a liquidity crisis could unravel the high yield bond sector if/when institutional investors decide that risk of recession continues to…Read More

Blythe Masters, once considered the “Babe of Investment Banking” in view of her long tenure and celebrity senior role at JPMorgan—which included her being credited for helping to create those snarkly financial derivative products known as credit default swaps (CDS), has since aspired to become known as either the "Blockchain…Read More

Institutional Investor Magazine has recently announced the world's top 35 FinTech Bankers, and... As astutely noted by Institutional Investor Magazine’s Senior Editor Jeffrey Kutler, “The origin of the term “fintech” is difficult to pinpoint; only very recently has it become an accepted label for one of the hottest segments of…Read More