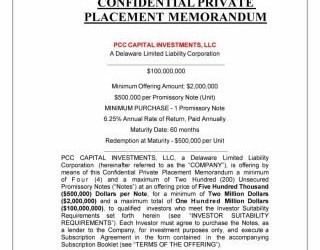

Cannabis cures all kinds of ailments (so they say..), but whether the plant-based elixir is framed as ‘medical marijuana’ or “recreational marijuana”, investing in a nascent stage, a fast growing enterprise, or even a cannabis fund that capitalizes on pot companies can be problematic, particularly via US exchanges. So, to borrow a phrase from Horace […]

Read More