Former Lehman Bros capo Richard Fuld likes acronyms, and somewhat out of character for the Big Dick many on Wall Street remember him to be, he also apparently likes the idea of inserting himself into a consortium that has created yet another new exchange platform--that eschews the notion of maker-taker…Read More

(Bloomberg) via (TradersMagazine) MarketsMuse Fintech team notes that Deutsche Bank AG’s Stephen McGoldrick, who was leading a consortium of banks and asset managers in developing a new European dark pool for stocks, has decided to leave the project. McGoldrick will return to his role as director of market structure at Deutsche…Read More

MarketsMuse ETF Curators debated on the title to this story, and first suggested the headline "Has BATS Gone Bats?!" While market structure experts continue to debate the topic of pay-to-play, i.e. payment for order flow schemes, BATS Global Markets, the youngest and arguably, now one of the largest electronic exchanges…Read More

Many fixed income folks are lamenting about liquidity in the corporate bond market. LiquidNet, the institutional trading platform is determined to make corporate bond trading more liquid..for the buyside. Just when you thought e-bond trading for corporate bonds was a never ending pipe dream... Liquidnet Launches Fixed Income Dark Pool…Read More

When ETFs were first launched in 1993, the 'framers' might not have fully appreciated what would happen to the respective ETF cash index in the event of a lopsided market opening when the underlying constituents had not yet opened for trading, despite the easy recall of October 1987.. Since that…Read More

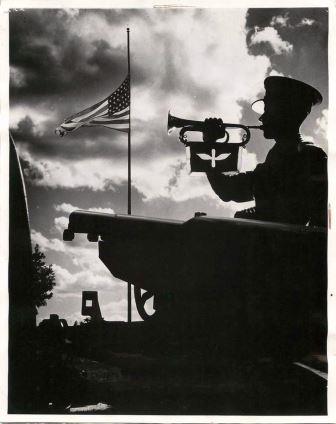

On the heels of the recent NYSE ‘outage’, which actually had little impact on overall equities trading volume, but did lead to volume spikes away from the NYSE and at competing exchanges across the fragmented marketplace, the volume also increased with regard to spirited discussions about market structure. And, whenever…Read More

MarketsMuse Global Macro Trading dept. merges with our ETF dept. to provide the following excerpt profiling a compelling and conservative Crude Oil-centric strategy courtesy of global macro think tank Rareview Macro LLC. The following was posted to subscribers of “Sight Beyond Sight” on Wednesday, May 27. Irrespective of subsequent three…Read More

The US Government Bond Market is set to explode...with more e-trading systems.. MarketsMuse Tech Talk continues its curating of fintech stories from the world of fixed income and today's update is courtesy of WSJ's Katy Burne, who does a superb job (as always) in summarizing the latest assortment of US…Read More

MarketsMuse.com Tech Talk update profiles the latest news flash for FinTech wonks: Whilst the securities industry landscape continues to debate the "dark pool vs. lit market" topic, the London Stock Exchange (LSE) is taking a chapter from the behometh brokerdealer universe with their own scheme to introduce a dark pool,…Read More

MarketsMuse options market update courtesy of extract from our friends at MarketsMedia LLC and their profile of yet another proposed options exchange with yet another “rebate” scheme intended to capture market share in the very competitive world of order routing. International Securities Exchange will have its ISE Mercury exchange ready…Read More

MarketsMuse update courtesy of extract from Pension & Investments Feb 23 edition, with story reported by Sophie Baker …MM Editor Note: The notion of buyside-only electronic trading venues for institutional equities (i.e. block trading) is not a new one. Graybeards who have been around for more than 15 minutes will…Read More

MarketMuse update courtesy of repurpose from Brokerdealer.com, originally from Traders Magazine, one of the sell-side’s top publications. Quantitative Brokers and RiskVal have formed a partnership to create and deliver a fixed income trading platform, called RVQB. The new sellside bond trading platform "combines powerful real-time analytics with seamless access to QB algorithms for…Read More

Greenwich Associates study reveals difficulty in executing corporate bond trades; Transparency and Liquidity are Lacking MarketsMuse update courtesy of extract from Jan 23 Wall Street Letter, followed by our own comments (thanks to our Exec Editor’s providing more than average knowledge of corporate bond trading and the assortment of electronic…Read More

MarketsMuse editor note: The following post, extracted from Jan 6 submission to ETFtrends.com is best described as an advertorial courtesy of WisdomTree Investments, one of the ETF industry’s leading Issuers. While readers of MarketsMuse might be inclined to muse “[This ‘case study’ is] Elementary, my dear Watson, totally elementary!,” MarketsMuse…Read More

Below extract courtesy of Wall Street Letter, as reported by WSL staff columnist Sean Creamer OMEX Systems, a provider of web-based, broker-neutral and FIX-compliant front, middle, and back office platforms for broker-dealers and buyside firms, will craft a direct market access offering to aid broker-dealers in choosing algo providers, according…Read More

Conflict of Interest is Of Interest to Senate Panel Members "just learning about" industry-rampant Payment For Order Flow Schemes . Market Structure To Be Re-Structured? Excerpts below courtesy of The Wall Street Letter's on the spot coverage of the U.S. Senate investigation of Wall Street's affection for high-frequency trading aka…Read More

Excerpt courtesy of TABB Forums April 21 submission by Chris Sparrow, CEO of "Market Data Authority" a consultancy that provides guidance within the areas of equities market structure, transaction cost analysis and "best execution." MarketsMuse Editor note: below snippet is a good preview to the most recent "short-form white paper"…Read More

MarketsMuse Editor Note: Having close on 3 decades "habitating" within the financial industry's sell-side, this greybeard former trader turned opinionator and postulator is certainly fascinated by the spirited debate over "high-frequency trading", not only because most of those arguing for and/or against HFT can only selectively point to lop-sided studies…Read More