If you are into fintech, that means you ‘get the joke’ when it comes to using algorithms aka “algos” and for institutional investors having an ax with regard to environmental, social and governance factors (commonly known as ESG investing), Arabesque Partners, a new player in the fund management space might have a solution for you.

(NYT)-Cracker Barrel Old Country Store, the company behind a chain of down-home restaurants, might not seem an obvious model for advanced financial technology. Its specialty is vintage: vintage food, and in its gift shops, vintage toys and vintage music in the form of hymnal CDs.

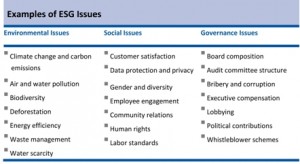

Yet an upstart fund manager called Arabesque Partners has determined that Cracker Barrel is among the most attractive investments out there in a special category that takes into account environmental, social and governance factors — known in the industry as ESG.

Yet an upstart fund manager called Arabesque Partners has determined that Cracker Barrel is among the most attractive investments out there in a special category that takes into account environmental, social and governance factors — known in the industry as ESG.

And even more intriguing: The calculation was not made by a human analyst, but by a robotic one.

In the most recent full quarter for which data was available, Cracker Barrel represented 1.31 percent of the Arabesque Prime fund, which factors in a company’s sustainability and corporate responsibility track record before investing. That was more than any other stock, including more obvious suspects like Unilever, the consumer goods giant that is obsessed with sustainability, and Xinyi Solar Holdings, a big maker of solar panel components.

Arabesque is one of a growing number of investors that are leaning on mountains of new data about companies’ environmental, social and governance performances in hopes of making more profitable trades.

New firms like Arabesque are making ESG data a core part of their strategy. Goldman Sachs has filed with the Securities and Exchange Commission to start an ESG-focused exchange-traded fund. And the biggest money managers in the world, including BlackRock, now regularly incorporate ESG analysis as they compose their portfolios.

Keep reading the NYT DealBook column by David Gelles here