Below excerpt is courtesy of today’s Rareview Macro a.m. edition of global macro strategy commentary “Sight Beyond Sight”…

Crude Oil

The professional community is honing in on to two crude oil observations overnight – one “temporary” and one “transitory”.

- Ali Al-Naimi, Saudi Arabia’s oil minister, said the global economic slowdown has contributed to a temporary “problem” in the market. (Source: Saudi Press Agency report)

- The Federal Reserve said it views the decline in the energy price as “transitory” which was forcefully reiterated many times during Chairwoman Janet Yellen’s press conference.

Here is a dirty framework to work with before you all get excited about this. Please note, this analysis is completely neutral as we have no axe to grind when it comes to Crude Oil and have not speculated in anything related to the black stuff for months. So the view is objective.

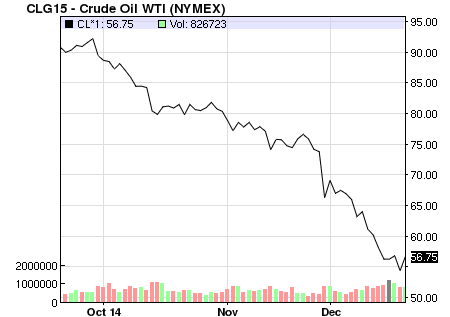

WTI is up 3-days in a row or 3.5%. Yesterday, it was up $3 but closed flat. At one point today it was up $2.26 and it is now only up $1.22.

Brent is up 2-days in a row 4.58%. Yesterday, it was up ~$3 but closed largely flat. At one point today it was ~$3 and is up only $1.62.

Simply put there are two kinds of bets professionals make when a historical event materializes, such as that we have just witnessed in crude oil.

The first bet is easy because all you have to do is adjust your portfolio based on the price targets that are changing as a result of the underlying commodity price falling.

The second bet is more difficult because it is one based on calling a bottom in the oil price, either as a result of backward looking data or else just plain old gut instinct.

Additionally, and because the debate fundamentally focuses on the supply side of oil, those using gut instinct looking to call a bottom can default to the places lower oil prices hurt the most (i.e. producing nations) and attempt to assess their tolerance levels with respect to the drop in prices and length of time.

From a behavioral science viewpoint, history suggests that a weak-handed investor, along with the news media, typically assumes that a lock-step $5 price move higher in oil signals a short-term bottom. Psychologically, this contingency will quickly move on to believing that a “V-shaped” bottom is right around the corner.

The problem with gut instinct, views on lock-step $5 moves or “V-shaped” bottoms, is that the poor fundamentals in the oil market are still very much in place and will be for an extended period of time.

For example, last night the finance minister of Nigeria, Dr. Ngozi Okonjo-Iweala, said its economy will now grow at 5.5% this year, rather than 6.35%. Additionally, a revised budget was released and it was based on an oil price of $65 a barrel, significantly lower than the previous assumption of $77.40. Given Nigeria’s government receives more than 75% of its revenues from oil exports we found this advice by Dr. Okonjo-Iweala – that Nigerians should “to begin thinking of the country as a non-oil country” – very significant.

As a reminder, on December 11th the largest sovereign wealth fund in the world and a key crude oil exporter, Norges Bank, forecast an average oil price in 2015 of $72/brl, and $77/brl for 2016. On the same day, the Russian energy ministry said it sees oil prices between $60-65 in January and February 2015.

So between three major oil producing nations on three continents – Russia, Africa, and Europe – the range is $60-72 for 2015 and in Q1 it is skewed towards the lower end of that spectrum. Put another way, that is right near the current trading price of Brent crude oil today.

So while some are enthusiastic about the bid-tone in oil you should be very mindful that the currency of Africa’s largest crude oil producer, the Naira (NGN), fell 4% last night, the most since January 2009 on a closing basis. At the same time, the Nigerian Stock Exchange All Share Index (symbol: NGSEINDX) retreated 2.78%, falling for an 8th successive day, to its lowest level since January 2013.

Foreign exchange market dealers linked the development to the Central Bank of Nigeria’s announcement that its Wednesday’s auction at the Retail Dutch Auction System window was the last for the year. Put in laymen’s terms, the US Dollar is no longer available at the RDAS window until January 5, 2015 and that means the central bank will likely need to spend reserves to defend the Naira at the interbank market regularly until the end of the year if it is to minimize pressure on the Naira.

The Central Bank of Nigeria, “in order to preserve the stability of the market”, changed the FX Trading Position of Individual Authorized Dealer to 0% from 1%. Again, in laymen’s terms banks are now required to maintain 0% of their shareholder’s funds as an FX position at the close of business each day. Statement

The key point here is that the after-shocks of lower oil prices are still being absorbed. Furthermore, you have to recognize that oil companies/producers are very scared and have not had an opportunity to really adjust their hedges/positioning due to the speed and degree of the collapse in prices. Therefore, for the first few bouts of crude oil strength, these power players will be sellers of crude oil into strength and we would speculate that is exactly what they have been doing. And that, in turn, is why the price gets ratcheted down at each new high.

For today, we are encouraged by the bid-tone in crude oil and the pause in the Russian crisis. However, professionals would be better served holding the view that the time to short oil may have passed for the remainder of 2014 but also that the opportunity to go long on crude is of a very low quality. The real risk is that after you get the $5 bounce, then the shorts that missed that the first time around come into the market knowing that the fundamentals will be poor until the spring at least. There will be a time to go long on oil but we are not there yet.

Swiss Franc

Unlike crude oil, we have been short of the Swiss Franc (CHF) largely all year and that remains one of our favored views going into 2015. As a reminder, we re-initiated a long Dollar-Swiss (CHF) position and levered-up that position via long-dated upside call options (i.e. CHF 9/7/15 C1.05) earlier this month. So we were very pleased to see that the Swiss National Bank (SNB) surprised the market today by cutting their deposit rate to negative -0.25%, slightly beyond the negative -0.2% by the European Central Bank (ECB).

To put the reaction in context, the Dubai Financial Market General Index (symbol: DFMGI) closed up 12.98% on the perceived stability in crude oil. Despite the DFMGI index showing the largest positive risk-adjusted return in Equities the Euro-Swiss (EUR/CHF) currency cross is showing the largest positive risk-adjusted return across all regions by a large margin.

Alongside the introduction of negative rates by the SNB, both the German 2 and 3-year yield is now trading negative. European yields also continued to move lower with numerous 10-year bonds hitting fresh record lows – Italy, Spain, Austria, Belgium, etc.

The read through from the SNB move to negative rates it that it increases the likelihood that the ECB will introduce QE sooner than expected, and it may be on a bigger scale than the market forecasts as well. In fact, the German Euro-BUXL (symbol: UBH5), which represents the longest part of their sovereign debt curve, is showing the largest negative risk-adjusted return in fixed income as some degree of discounting is required for Germany to absorb the rest of the Eurozone’s liabilities via QE.

It is clear that since last week’s SNB meeting those policy makers have been unhappy with the size of intervention it was being forced to undertake – sitting on the bid and absorbing all that flow – as a result of the events in Russia.

Note that the deposit rate cut will be formal as of January 22nd. Technically, that is because they calculate interest on a monthly basis and it is charged at the end of each month for the period of the previous month.

Coincidentally, that date just so happens to be the same day as the next ECB meeting and interest rate decision.

Now we do not like to embrace conspiracy theories. But after yesterday’s surprise announcement by President Obama to lift the ~50 year embargo on Cuba we will not rule anything out. The key point here is that Cuba was a key staging ground for Russia and Venezuela and, as part of this chess game that military sea access was just taken away from those two countries the day after Russia raised interest rates dramatically.

Now a lot of professionals are already disappointed in the resulting price action in the Euro-Swiss (EUR/CHF) and Dollar-Swiss (USD/CHF). One would have thought with only 10% of market participants expecting a December surprise that the Swiss Franc would be a lot weaker at the open, especially against the Dollar following Chair Yellen’s press conference yesterday.

What we would say is this:

To continue reading today’s insight from Rareview Macro’s “Sight Beyond Sight”, MarketsMuse invites you to secure a subscription (15-day free trial or 1 month or Annual) directly via the publisher’s site