Professional Investment Community Cries Out in Agony and They Don’t Yet Know Exactly Why MarketsMuse Strike Price and Global Macro curators voted the Oct 5 edition of global macro advisory firm Rareview Macro's Sight Beyond Sight the best read of the week. Yes, its only Monday, but those who follow…Read More

For Wall Street bankers and brokers who have been in the business since at least the early 2000's and are still working on the Street, and who think you've already been pilloried plenty for the work you do, watch out, former Lehman broker-turned best-selling author Michael Lewis ("Liar's Poker", "Money…Read More

MarketsMuse Global Macro merges with Strike Price seers with sage excerpt from 18 Sept edition of "Sight Beyond Sight", the daily newsletter published by global macro think tank Rareview Macro and authored by Managing Member Neil Azous and rising star Michael Sedacca...For fans of the film Draft Day, this excerpt…Read More

One needs to have 'been there and seen that' for at least twenty years in order to have been "loaded for bear" in advance of this morning's equities market rout. At least one of the folks who MarketsMuse has profiled during the past many months meets that profile; and those…Read More

MarketsMuse Strike Price section spots news that BATS Global has received approval from the Securities and Exchange Commission to open its second options trading venue, EDGX Options. Launch of the EDGX Options system is tentatively set for Monday, November 2, BATS said. The actual SEC Approval Order from the SEC…Read More

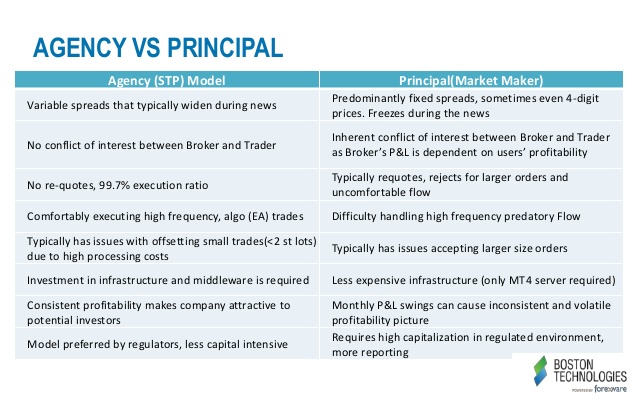

MarketsMuse dip and dash department frequently prefers spotlighting altruists and do-gooders, including Agency-only execution firms in the brokerdealer sphere who, unlike “principal trading desks”, do not take the contra side to institutional customer orders as a means of making a profit; agency-only firms merely execute those client orders via the…Read More

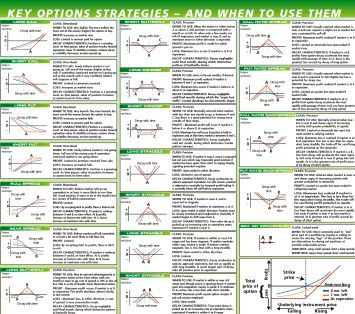

MarketsMuse Strike Price update profiles a “return from the past and into the future” look at what many veteran (and former) option mart floor traders had all but given up for lost thanks to the electronification and bifurcation of institutional options trading. We’re talking about those legacy, open-outcry trading pits,…Read More

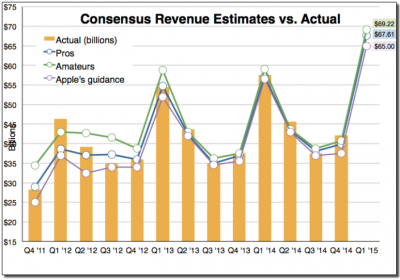

MarketsMuse.com Strike Price update takes a swipe at the plethora of sell-side analysts already dueling on air in advance of Apple Inc.'s April 27 quarterly earnings release (folks who will be proffering their respective EPS outlook post mortems and assortment of "consensus" talking points and take-aways after Tim Cook steps…Read More

MarketsMuse.com Strike Price section profiles trading systems vendor Dash Financial algorithm-based approach to securing options market “best execution” in the ever-increasing world of options mart fragmentation and the wacky rebate schemes that have proliferated across the electronic options exchange landscape. Below is courtesy of extracted elements from MarketsMedia.com April 20…Read More

MarketsMuse.com Strike Price update profiles the most recent plan for yet another Options trading platform on the part of BATS. Coverage is courtesy of TradersMagazine. BATS Global Markets has announced they are opening a second U.S options marketplace, EDGX Options. According to BATS, EDGX Options will be based on a…Read More

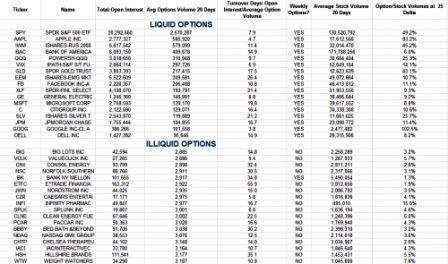

MarketsMuse.com Strike Price update strikes at the heart of how the financial industry’s new regulatory regime is impacting liquidity across the institutional options market, courtesy of 09 April coverage by MarketsMedia.com. Regulatory requirements that dealers keep more capital on their balance sheets is squeezing options liquidity for institutional traders, who…Read More

MarketsMuse.com Options market update focuses on recent industry report canvassing the perch of buyside managers perspective as to the good, the bad and the ugly sell-side broker elements they encounter in the course of increasing use of listed options products is courtesy of recent report issued by industry think tank,…Read More

MarketsMuse options market update courtesy of extract from our friends at MarketsMedia LLC and their profile of yet another proposed options exchange with yet another “rebate” scheme intended to capture market share in the very competitive world of order routing. International Securities Exchange will have its ISE Mercury exchange ready…Read More

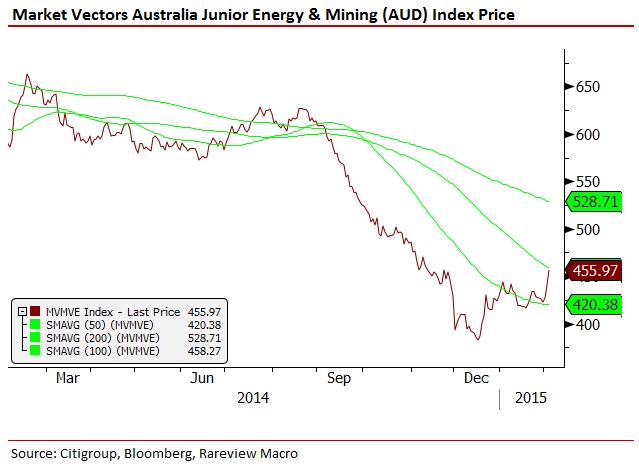

MarketsMuse update profiling a very intriguing options strategy for professional traders is courtesy of a.m. edition of "Sight Beyond Sight" , the global macro strategy-centric publication from Rareview Macro LLC. The MM editors include former option market-makers and we're reasonably confident that the following idea has not yet been considered…Read More

MarketsMuse options market coverage of MIAX, the latest entrant to the continuously fragmented world of securities exchanges is courtesy of Traders Magazine Options industry market makers, Citadel Securities LLC, KCG Americas LLC, Morgan Stanley & Co. LLC, Optiver US LLC, Susquehanna Securities, Timber Hill LLC, and Wolverine Trading, LLC have…Read More

MarketsMuse global macro trading insight courtesy of extract from 4 Feb edition of Rareview Macro LLC’s “Sight Beyond Sight” with reference to $MVE and $MVMVE [caption id="attachment_2349" align="alignleft" width="150"] Neil Azous, Rareview Macro[/caption] There are a lot of moving parts overnight, including the continuing debate on whether crude oil has…Read More

MarketsMuse.com update courtesy of extracts from today’s edition of Traders Magazine. Yet another coin is being tossed into the fountain of Bitcoin dreams and wishes. The latest aspirant and first to file a full-blown registration for a "Bitcoin Bourse"with the CFTC is “LedgerX”, a company led by former 6-pack broker-dealer…Read More

MarketsMuse update courtesy of AsiaAsset News The Shanghai Stock Exchange (SSE) will unveil its first ETF option next month as a testing ground for the pilot stock option trading program in China. The China Securities Regulatory Commission (CSRC) said it has authorized the SSE to launch the pilot program with…Read More