Courtesy of WSJ Dec 28 Weekend Edition and reporter Joe Light

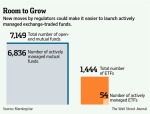

The world of ETFs is about to get pumped up.

A long-heralded blossoming of actively managed exchange-traded funds is one step closer, now that the Securities and Exchange C ommission earlier this month removed a hurdle that discouraged money managers from releasing such products.

ommission earlier this month removed a hurdle that discouraged money managers from releasing such products.

For small investors, the change could mean more choices. But it also could cause money managers to add more risk to their portfolios as previously forbidden investment strategies become available, analysts say.

In March 2010, the SEC stopped approving new actively managed ETFs that use derivatives, which are contracts that derive their value from that of underlying securities, such as options and credit-default swaps. Portfolio managers use derivatives frequently in actively managed mutual funds to protect against the threat of bond defaults, currency fluctuations and other risks. The ban discouraged fund companies from starting actively managed ETFs. Instead, the vast majority of ETFs are low-fee index funds, which passively track an established benchmark.

Earlier this month, Norm Champ, director of the SEC division of investment management, said in a speech that the agency now will approve the use of derivatives in ETFs under certain conditions.

New Strategies

The end of the moratorium might encourage some money managers to launch new active ETF strategies, while active ETFs already on the market might start using them in their portfolios, says Robert Goldsborough, an ETF analyst at investment-research firm Morningstar.

The end of the moratorium might encourage some money managers to launch new active ETF strategies, while active ETFs already on the market might start using them in their portfolios, says Robert Goldsborough, an ETF analyst at investment-research firm Morningstar.

“This definitely gives a money manager more flexibility and more options in shaping a portfolio,” he says. “At the margin, it removes an impediment that some money managers might have had that prevented them from moving ahead.”

Up to now, the active-ETF universe has expanded slowly. The first active ETF, launched by Bear Stearns in 2008, folded that same year. Now, there are 54 active ETFs on the market with about $10.4 billion in combined assets, according to Morningstar. That is up from 39 ETFs and $5 billion at the end of 2011.

Much of the growth came from just one fund launch: Pimco Total Return, managed by bond guru Bill Gross. The fund debuted in March and now has some $3.9 billion in assets.

Money-management firms that have submitted initial filings for ETFs but not yet moved forward include giants such as Fidelity Investments, T. Rowe Price Group and Legg Mason. Some of them and other firms, including OppenheimerFunds and Vanguard Group, have written letters to the SEC encouraging officials to lift restrictions on derivative use in new active ETFs.

Since there are few active ETFs on the market right now, the immediate impact of the SEC’s decision for small investors might be muted, says Tom Lydon, chief executive of Global Trends Investments, an advisory firm that runs the ETF Trends website. But the approval could make it more attractive to some money managers to launch new ETFs, he says.

“Derivatives are an active-management tool that many depend on these days. If you don’t have that arrow in your quiver, you’ve been somewhat handicapped,” he says.