There continues to be a call for clarity with regard to the topic of corporate bond ETF liquidity and where/how corporate bond ETFs add or detract within the context of investors ability to get 'best execution' when secondary market trade in underlying corporate bonds is increasingly 'illiquid.' This not only…Read More

MarketsMuse update inspired by yesterday’s column by Tom Lydon/ETFtrends.com and smacks at the heart of what certain “bomb throwers” believe could be a Black Swan event, albeit an event that may not be driven by a global crisis or surprise economic event. The event in question will, in theory, take…Read More

Jane Street Capital, the quant-centric proprietary trading firm best known for its dominant role in the ETF marketplace--including its role as a liquidity provider for stocks and options as well as exchange-traded funds to buy-side accounts-- has a new arrow in its quiver; making markets in corporate bonds. The firm…Read More

Well Matilda, as if the universe of corporate bond electronic trading platforms isn't crowded enough, despite clear signs of consolidation taking place for this still nascent stage industry (e.g. upstart Trumid's recent acquisition of infant-stage Electronifie) , one more corporate bond e-trading platform has its cr0ss-hairs on the US market.…Read More

The 2016 BEST ETF funds and People in the ETF industry...Each year, ETF.com and Inside ETFs orchestrate a list of Best Of-the top ETF funds and ETF industry players who have made the greatest positive impact on the industry and investors in exchange-traded funds. The nomination process and voting process…Read More

Fintech Fixed Income Trading & Fragmentation-What's Next? A Venue for Private Placement Bonds & MTNs Despite the seeming oversupply of electronic bond trading initiatives, the convergence of fintech and fixed income trading continues to spawn new electronic trading start-ups, bringing the total industry count to 128 venues. The latest player,…Read More

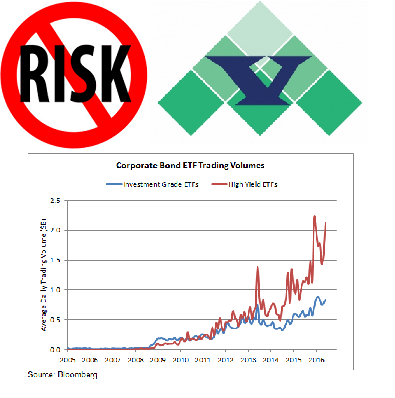

Virtu Says NO to Corporate Bond ETF risk-taking; Top Market-Maker Opines “Unable to Hedge ETF Constituents Due To Limited Liqudity” During the better part of three years, MarketsMuse Fixed Income curators have often pointed to concerns expressed by market professionals who argue that the unfettered growth of corporate bond ETFs…Read More

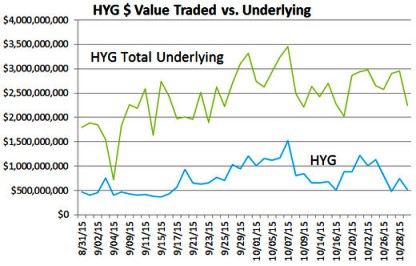

Corporate Bonds and exchange-traded funds is a combination that first seemed counter-intuitive to the select universe of traders who are actually fluent in both corporate bond trading and equity trading; two practice areas that are distinctively different. “Stocks are bought and bonds are sold” as they used to say, and…Read More

MarketsMuse ETF and Fixed Income curators have frequently spotlighted the ongoing debates as to whether corporate bond ETFs, and in particular, junk bond-specific exchange-traded-funds pose special risks. Some argue that a liquidity crisis could unravel the high yield bond sector if/when institutional investors decide that risk of recession continues to…Read More

In the wake of recent weeks' volatility and pricing dislocations across the exchanged-traded product space, news media and Mutual Fund marketers are having a field day putting the feet to the fire--and those toes being torched are connected to the universe of juiced-up and levered ETF and ETN products, as…Read More

MarketsMuse ETF and Fixed Income departments merge and gives credit to Morgan Stanley as they raise their own ETF flag with an innovative idea to package a single corporate bond issuer’s debt into one neat package so that ETF investors can express their bets on the issuer’s outstanding credit… Here’s…Read More

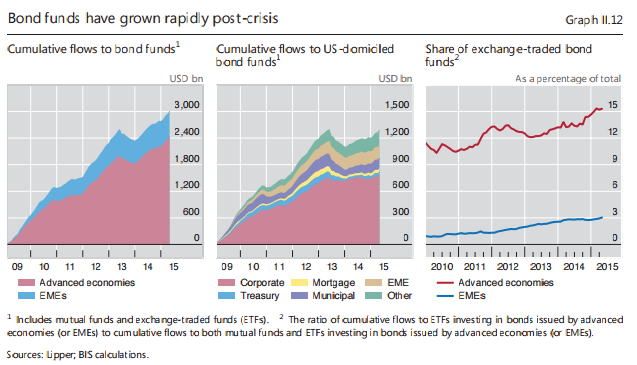

MarketMuse update profiles the billions of dollars that have flowed into bond ETFs over the past few years and an in depth look at the reasoning behind it courtesy of the Wall Street Journal . Institutions are piling into exchange-traded bond funds at the fastest pace on record, driven by forces…Read More

MarketsMuse.com blog update courtesy of press release from Tabb Group and profiles new research report focused on institutional investors’ growing use of corporate bond ETFs. NEW YORK & LONDON--(BUSINESS WIRE)--In new research examining accelerating growth in the corporate bond exchange-traded fund (ETF) market, which has seen assets under management (AuM)…Read More

Greenwich Associates study reveals difficulty in executing corporate bond trades; Transparency and Liquidity are Lacking MarketsMuse update courtesy of extract from Jan 23 Wall Street Letter, followed by our own comments (thanks to our Exec Editor’s providing more than average knowledge of corporate bond trading and the assortment of electronic…Read More

MarketsMuse Editor Note: Our editorial team leader has spent more than 15 minutes across the capital markets throughout almost 30 years and in the course of hearing and reading about all of the most recent initiatives to electronify the corporate bond markets so as to 'get in front' of the…Read More

If this week's volatility has unnerved you, take a deep breathe, sit back and consider the following assessments courtesy of global macro strategy think tank Rareview Macro and extracts of this a.m. edition of "Sight Beyond Sight." The Puzzle [caption id="attachment_1904" align="alignleft" width="200"] Neil Azous, Rareview Macro LLC[/caption] Today's edition…Read More

Index fund managers are finding it challenging to ensure the bonds they need in the prices they want, driving them to make trade-offs that leave supervisors vulnerable in a market downturn and may hurt investors. Bond liquidity has all but dried up for corporate problems after new regulations and capital…Read More

Courtesy of Dave Nadig MarketsMuse Editor Note: For those unfamiliar with the logistics of buying and selling corporate bonds in the secondary market, and particularly for those not fluent in why/how corporate bond ETFs are priced and trade, the following column courtesy of IndexUniverse's Dave Nadig provides a good…Read More